Banking & Financial Services

Digital transformation in banking post COVID-19

COVID-19 pandemic is undoubtedly one of the worst challenges faced by the banking industry. The current crisis has made it challenging for banks to manage their daily operations and customer expectations while dealing with the new normal. However, this pandemic has...

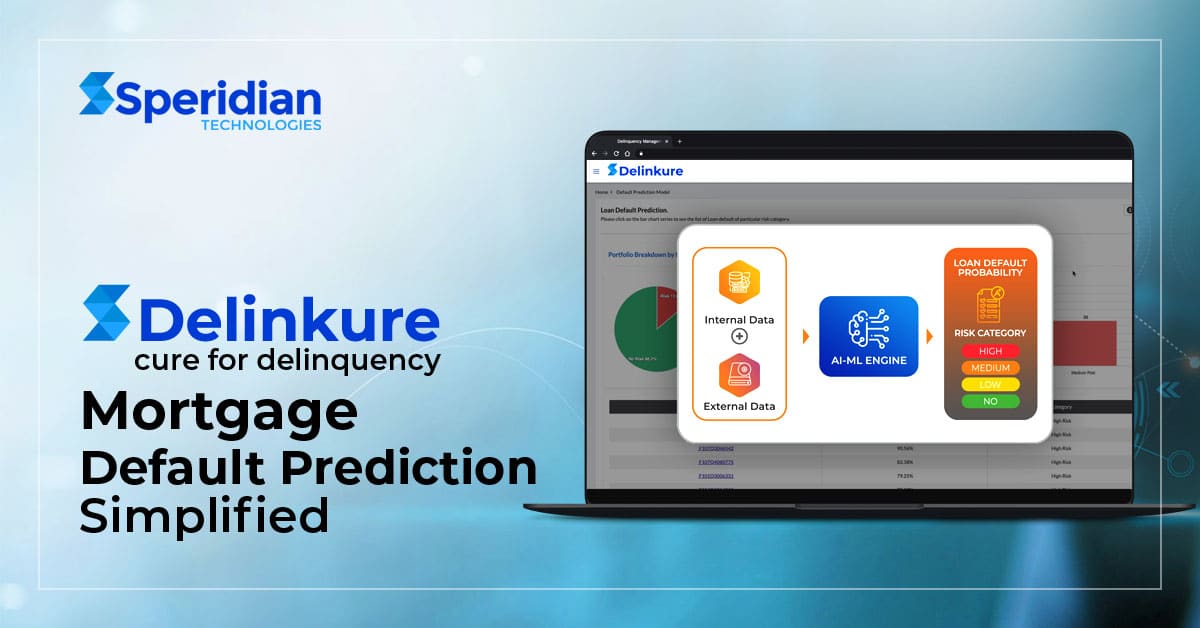

Speridian Technologies launches Delinkure, a next-gen, analytical solution for the mortgage sector. Delinkure focuses on managing portfolio risk by predicting default and providing optimal resolution options.

Speridian Technologies launches Delinkure, a next-gen, analytical solution for the mortgage sector. Delinkure focuses on managing portfolio risk by predicting default and providing optimal resolution options. Irvine, CA: Speridian Technologies, a global business and...

Manage Portfolio Risk using Predictive Analytics

To minimize loan default losses, reviewing and assessing mortgage portfolios periodically is crucial for Lenders, Servicers and Investors. Typically, loans deemed risky are eligible for term renegotiation or other Early Resolution measures.

Reduce the Impact of Moratorium using ML-based Intelligent Loan Collection Solution

Machine Learning (ML-based) predictive analytical tool intelligence for loan collection systems effective for financial institutions for their credit risk.