Speridian’s BEACON Follow-Up Empowers Canara Bank to Lend With More Freedom, Less Fear

The Banking industry in India continued to face a challenging period with increase in Non-Performing Assets (NPAs) particularly from corporate segment due to various macroeconomic and other factors.

Speridian’s Beacon Delinquency Management streamlines loan recovery

Our client, a major Indian regional bank, adopted Speridian’s Beacon Delinquency Management solution to improve their loan business. Doing so allowed the bank to improve loan decision making, minimizing Nonperforming Assets, easing the burden and improving the success rate

Speridian’s Beacon E-Village Solution transforms cashless payments

Client Our client, a major Indian regional bank, adopted Speridian’s Beacon E-Village Solution to create a digital payment platform. This helped them navigate Indian demonetization, which had proven to be challenging, particularly in rural areas. In doing so, it allowed

Speridian’s Beacon Mobile Banking Solution enables anytime anywhere banking

Our client, a major Indian bank, started using Speridian’s Beacon Mobile Banking Solution, to provide simpler and easier mobile transaction services to their customers. This enhanced the Bank’s appeal, particularly among the younger demographic.

Speridian’s Beacon Data Analytics Solution re-imagines corporate reporting

A large Cooperative Bank with a long history and extensive amounts of client information trapped in multiple systems.

Speridian’s Beacon Core Banking Solution enables Indian bank to automate end-to-end operations

Client Our client, a major Indian bank, became the first bank in the country to automate their Core Banking. They did so by adopting Speridian’s Beacon Core Banking Solution (CBS). This adoption helped change the landscape for Indian banking nationwide

Speridian’s Beacon Banking Solution transforms leading Indian co-operative bank

Client Our client is a leading co-operative bank in India. As the foundation for their […]

Revamping Digital Debt Collection and Recovery Solutions

In the banking and financial services (BFS) sector, delays and defaults represent significant challenges in […]

Digital transformation in banking post COVID-19

COVID-19 pandemic is undoubtedly one of the worst challenges faced by the banking industry. The […]

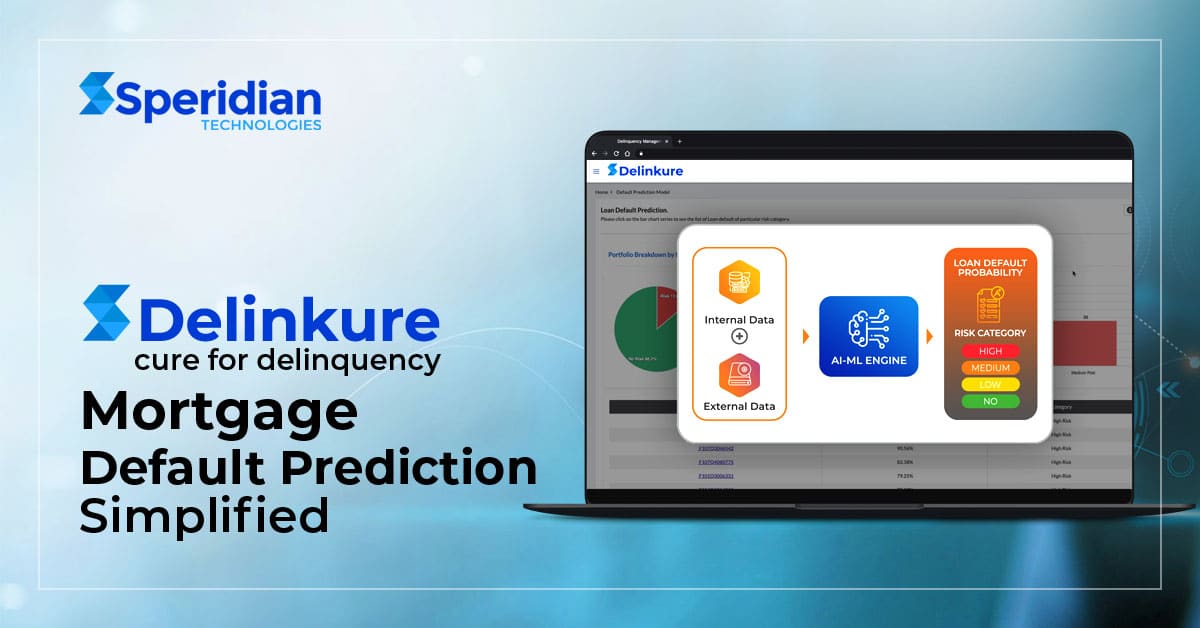

Manage Portfolio Risk using Predictive Analytics

To minimize loan default losses, reviewing and assessing mortgage portfolios periodically is crucial for Lenders, Servicers and Investors. Typically, loans deemed risky are eligible for term renegotiation or other Early Resolution measures.

Reduce the Impact of Moratorium using ML-based Intelligent Loan Collection Solution

Machine Learning (ML-based) predictive analytical tool intelligence for loan collection systems effective for financial institutions for their credit risk.

Embracing Digital Banking To Augment Your Customer Experience

Beacon Digital Banking for financial institutions away from customers in terms of providing the personnel touch know more about Speridians’ Banking Product.

Banking Technology Innovations

Banking Technology Innovations & financial institutions are turning to Digital automation and Robotics, making their existing systems efficient. Learn More…

Speridian enables first ever Co-operative Bank in India to automate Financial Inclusion Services

Client Our client, a major Indian bank, became the first in the country to automate Financial Inclusion services. They did so by adopting Speridian’s Beacon Financial Inclusion Solution (FIS). This move was extremely successful and set a nationwide model for